4. Balancer

This module is a key part of the PAB Client library. Unbalanced transactions requires several modifications until they can be signed and submitted to the blockchain, and the balancer module takes care of this.

Moreover, the module is a full-featured general purpose Cardano balancer, so it can be used to balance transactions built in any possible way, not only with the PAB.

Currently, the balancer supports Cardano transactions up to the Alonzo era, including of course all Plutus-related features. Next version will include support for Babbage era features.

4.1. Balancing process overview

Recall that in our approach, the PAB builds transactions that has only set those aspects that reflect the abstract logic of the operation we want to perform in our dApp. All the bureaucratic aspects of the transaction are left to the balancer.

The main purpose of the balancer is to perform these two steps:

1. Properly balance the transaction, this is, add wallet inputs to pay the value that is not already yet covered by the inputs, and change outputs to pay back to the user wallet the leftover value.

2. Compute and set the transaction fee, and the memory and CPU budget for every redeemer. To do this, the balancer must have access to a budget service.

However, there is a circularity between these two goals, because step 1 requires to know the fee value computed in step 2, as the balancing condition is:

total input value + minted value = total output value + burned value + fee

At the same time step 2 requires the execution of the Plutus scripts in the same conditions as it will be executed in the blockchain, including the inputs and outputs added in step 1.

Our workaround for this circularity is to perform step 1 using an upper bound for the fee that must be provided when calling the balancer.

After this, step 2 can be performed with a transaction that looks almost exactly like the one to be submitted, obtaining very precise budgets and therefore a very precise fee value.

Last, as the fee obtained in step 2 will be smaller than the upper bound used in step 1, a small readjustment must be done in the ADA value of the change output, in what we call the rebalancing step. This change is so small that it does not affect the execution budgets.

Besides these main goals, the balancer must also take care of other minor aspects of the transaction, all related to compliance with the Cardano specification:

Add the collateral input.

In the redeemers list, readjust the “spend” indexes to match the new input list.

Recompute the

script_data_hashfield according to the new witness set.Optionally, merge all outputs paid to the change address.

4.2. Example: An escrow resolve

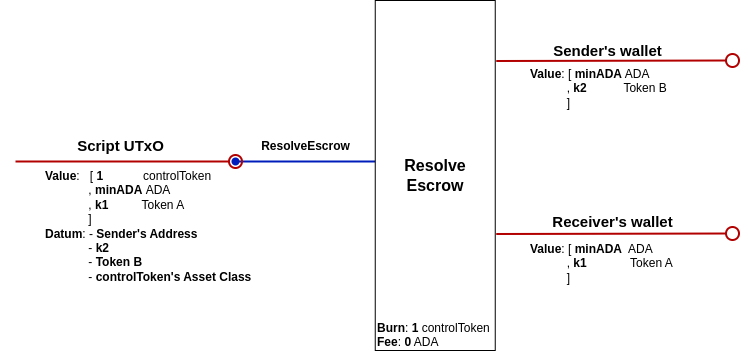

In the escrow example, the resolve operation creates a transaction that consumes a script UTxO that corresponds to an escrow started by a sender. To resolve it, the transaction has two outputs: An output that pays to the sender the tokens he expects, as indicated by the escrow datum, and another output that pays to the receiver the tokens locked in the escrow by the sender.

The following diagram illustrates the unbalanced transaction provided by the PAB after a call to the resolve endpoint:

Here, it can be seen that the tokens paid to the sender are not yet present in any input of the transaction. It is work of the balancer to search in the receiver’s wallet for the UTxOs that can cover this payment, and add them as inputs.

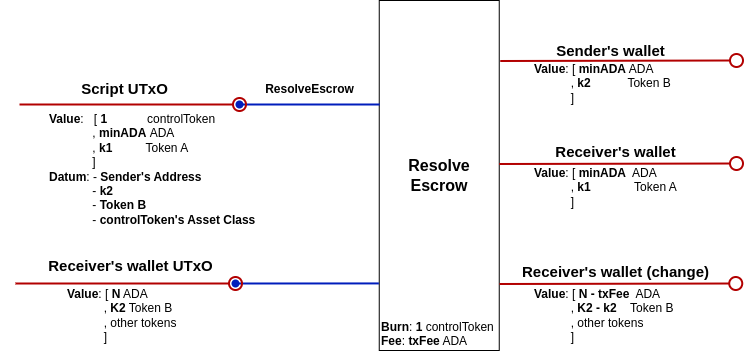

A possible result of the balancing process can be the transaction illustrated by the following diagram:

In this case, the balancer was lucky enough to find all the required tokens to be paid in a single wallet UTxO, so it was only necessary to add one input. Also a new output was added, the change output, used to pay back to the wallet the leftover funds.

4.3. Helper modules

As balancing requires a lot of contextual information, it is easier to use the

balancer in connection with other modules provided by the PAB Client library,

such as ContractEndpoints (described in the previous section),

CIP30WalletWrapper and TxBudgetAPI.

The CIP30WalletWrapper modules provides typing and additional functionality

to the basic wallet javascript API defined in CIP 30.

To instantiate a CIP30WalletWrapper, we must first obtain the CIP 30 wallet

from the browser and enable it. The getWalletInitialAPI function can help

with this. For instance, we can load the Eternl wallet and wrap it the

following way:

const { getWalletInitialAPI } = await import("cardano-pab-client");

const walletName = "eternl";

const walletInitialAPI = getWalletInitialAPI(window, walletName);

const walletInjectedFromBrowser = await walletInitialAPI.enable();

const wallet = await CIP30WalletWrapper.init(walletInjectedFromBrowser);

The TxBudgetAPI is an API to access the budget service.

We can instantiate it as follows:

const { TxBudgetAPI } = await import("cardano-pab-client");

const budgetUrl = "http://localhost:3001"

const txBudgetApi = new TxBudgetAPI({

baseUrl: budgetUrl,

timeout: 10000,

})

4.4. Instantiate the balancer

To instantiate the balancer we must only provide the protocol parameters of the blockchain we are using. The PAB Client library includes a function to query the protocol parameters using Blockfrost:

const { Balancer, getProtocolParamsFromBlockfrost } = await import("cardano-pab-client");

// Initialize Balancer

const protocolParams = await getProtocolParamsFromBlockfrost(

blockfrostUrl,

blockfrostApiKey,

);

const balancer = await Balancer.init(protocolParams);

4.5. Call the balancer

The easiest way to use the balancer is by calling the fullBalanceTx

function, that takes care of the whole work following the previously described

process.

To call fullBalanceTx, we must provide the following parameters:

public async fullBalanceTx(

{ transaction, inputs },

{ utxos, collateral, changeAddress },

{ feeUpperBound, mergeSignerOutputs, changeOutputIndex },

exUnitsEvaluator,

)

As you can see, the parameters are logically grouped, and the grouping also makes it easy to obtain them from the helper modules:

Transaction related (provided by

ContractEndpoints):transaction: The unbalanced transaction (a string with the CBOR in hexadecimal format).inputs: The information about the script inputs.

Wallet related (provided by

CIP30WalletWrapper):utxos: Wallet UTxOs that can be selected for payment.collateral: Collateral UTxO.changeAddress: Change address.

Balancing settings:

feeUpperBound: Fee upper bound in lovelace.mergeSignerOutputs,changeOutputIndex: Other optional parameters.

exUnitsEvaluator: Connector to the budget service (provided byTxBudgetAPI).

For example, if we have correctly instantiated contractEndpoints,

wallet and txBudgetApi, we can obtain a transaction from the PAB and

fully balance it the following way:

const pabResponse = await contractEndpoints.doOperation(...);

const walletInfo = await wallet.getWalletInfo();

const balancerResult = await balancer.fullBalanceTx(

pabResponse.value,

walletInfo,

{ feeUpperBound: 1000000 },

txBudgetApi

);

if (failed(balancerResult)) {

... // here take a look at balancerResult.error

}

const balancedTx = balancerResult.value;

The balancer returns an object of type Result<string>. The utility type

Result implements a design pattern for operations that can succeed or fail

without using exceptions. If the call is successful, the balanced transaction

can be found in the value attribute.

4.6. Other uses

For the escrow example, fullBalanceTx is good enough to cover all our needs.

However, in some cases more flexibility may be needed. For instance, a possible

balancing approach is to use hardcoded values for memory and CPU budget,

removing the need for the budget service. In this case, the following lower

level functions of the balancer library can be used:

balanceTx

setExecutionUnits

rebalanceTx